Introduction

Well I just wrapped up my final days at work. As I posted in detail before I gave my 2 weeks notice on January 23rd 2017.

My goal with this blog is for others who want to follow can see the path from the start not just in a year or two when I’m already having great success and by then it does not seem easy to achieve from someone elses perspective.

But I wanted to take a quick detour this week from the linear progression of preparing to quit, actually quitting and then building success with an online business.

I will start again with my next post on next steps (like my first month with no job).

I wanted to post today on a question I’ve been getting a lot already since starting this blog. In a previous post I talked about the 2 common methods to quit your job and pursue and Internet Lifestyle.

The Burn the Ships Method – You just quit and go all out to make it work in your business with nothing to fall back on if it does not succeed.

The Safety Net Method – You save up a certain amount of money to cover living expenses before quitting your job and ease out of it.

I talked about how I chose the Safety Net Method and decided to save over a years worth of living expenses before quitting.

A frequent question I got from people after that post is:

How the heck did you save enough money to cover living expenses for a year?

That is the question I am going to answer in this post. I am going to lay out my step by step strategy for saving a years worth of living expenses before leaving your job.

Preparing For Take Off

One of the beautiful things about the Safety Net Method is it allows you to validate your business. You can start your business while you are still working your day job and see if it can eventually make enough to sustain you if you quit.

You should keep all the money you make from your business completely separate from your personal accounts. Use the business funds only to pay off business expense and reinvest in your business.

You should try to save all the profit you make from your business in its own account. For the last few months I was making between $125k – $150k (annual) at my day job + another $6-$8k (monthly) from Internet business so the temptation was to increase my cost of living and spend more with that additional income.

Instead I resisted and pretty much ignored any profit from my side business. I just left it in my business account and only touched it when I had an expense related to business.

So by doing that for awhile I now already have about 1/2 of my savings for the year in my business account. I will start to pay myself a salary from this account to replace the income from my day job.

This will put me in the Red each month as my ‘salary + business expense’ is higher that what the business makes right now.

I plan on getting the profit way up in the business that first part of the year now that I’ll be fully dedicated to it and hopefully can get it to cover all my business expense plus my personal income.

But besides this obvious method of starting a side business and waiting until you have a year living expense saved up from just that, I want to go a bit deeper with you on the issue of savings.

You see even if I did not have the money saved up from my business, I could still take a year off from my personal savings.

And that is because I have mastered my own personal finance method, that keeps me out of debt and pretty much worry free and also has money working for me earning interest each month.

My Background In Personal Finance

Before I ever heard of Internet Marketing or decided I wanted to be an entrepreneur I was determined to figure out my personal finances.

I did not grow up with much money and had no one to show me even the basics about it. Like many younger Americans the trap was first set when I turned 18 and started getting all these credit card offers in the mail.

Not quite understanding how that worked I got into credit card debt heavy and from there it was vicious, vicious cycle that lasted for many years.

Every time I paid off a credit card another emergency would come up and Id have to get right back into debt again. I could never save any money and was paying a huge penalty for the “privilege” of borrowing money on a credit card.

I thought the answer was to make more money but although my standard of living raised my debt and money issues just got bigger and bigger.

I started to devour personal finance books but I still couldn’t completely get out of debt and struggled with making and following a budget.

Finally after many years I came up with my own system. Based off the Pareto Principle or the “80/20 Rule” I found a way to automate my wealth building plan stress free, with no budgeting or difficult self discipline to follow.

My 80/20 Rule to Personal Finance

This not directly related to Internet business and quitting your job but I believe this will help you tremendously in your financial life. And if you have your financial life in order its much easier to quit your job.

I believe so strongly in this plan that I will be writing a book on just this subject in the future but here I will give you the nutshell version.

After years of reading financial books and personal experimentation I came up with this system that has worked perfect for me and I truly believe can work for ANYONE struggling with credit card debt and savings, if they stick with it.

The end goal is:

- To be out of credit card debt.

- Have an emergency fund so you never need to use a credit card again.

- Have 3-6 Months Full living expenses saved just in case.

- Have interest bearing accounts you continue to build your wealth with for the rest of your life.

If you use this system you do NOT:

- need to track what you spend

- need to spend much time thinking about your finances (probably about an hour or two a month)

- need amazing financial skills

- need crazy self discipline

- and you do NOT need to deprive yourself or sacrifice much.

ALL you need to do is consistently follow what’s described below (I’m talking forever).

Step 1> Use the 20% income to initially get an emergency fund.

Step 2> Use the 20% to pay off credit cards and all high interest consumer debt.

Step 3> Build Your Flex Fund

Step 4> Build Your Freedom Fund

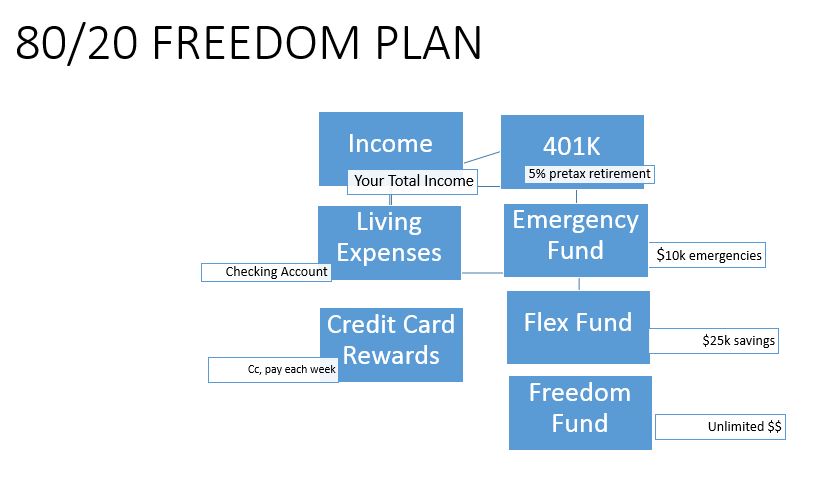

80/20 Principle Wealth Building

Use 20% of after tax income for wealth building accounts. Use 80% to live on.

Every single time you get income subtract 20% and put into the wealth building ladder.

If you have a job match your employer’s pre-tax 401k plan first before other steps.

Put ALL the rest of your pay into a primary checking account.

Take 20% from every paycheck or income that is deposited to the checking account and immediately put it towards Wealth Building Accounts. (non retirement).

That is Emergency Savings, Long Term Savings (3-6 months living expense), Investment accounts.

Pay your living expenses with as much as possible on a rewards Credit Card and pay the entire balance off every week. Only do this if you are extremely self disciplined. I pay off my FULL credit card balance every Friday.

I use a Chase Sapphire Preferred Card. With putting as much living costs as possible on here its given me about 2-3 free trips a year including a free round trip flight to Germany.

20% Wealth Building Accounts in Order

Make sure to fill these in order. Fill the Flex Fund fully then move onto the Emergency Fund etc….If you put 20% towards it every month these will fill quickly and you will eventually get to the fun part which is the investment accounts.

For some people it will take less than a year to get to step 3 and 4 for some much longer.

It does not matter how long it takes you.

Just keep putting away 20% and you will eventually get there!

Here is what my current Freedom Fund Ladder looks like:

- Flex Fund $10,000 in a regular Savings Account. This is to ensure that I never go into credit card debt for any minor emergencies or vacations etc…

- Emergency Fund $30,000 in Interest Savings Account. This is for longer emergencies lose your job etc. I have about 3 months full living costs here. I use a Capital ONE 360 Savings Account so I can get a bit of interest.

- Freedom Fund $20,000 -? High as you can. This is for long term savings. It uses an Index fund so their is rapid growth. Should be used for non retirement long term investing. After you have filled the first 2 keep putting the 20% here every month. I have a Betterment account.

- Just for Fun Fund $10,000 – $15,000 I put in a little bit of ‘play’ money for individual stocks. This should not be taken to serious as an investment. I use Charles Schwab.

Id also like to point out that there are other investments you can make that are potentially more lucrative and could give you faster and bigger returns. Like investing in your own business, another business or real estate.

Update: So its 2024 and I’ve used all the Internet skills learned in the past 7 years to become partner in a company.

A Hibachi chef started taking his talents to peoples home for a Benihana style experience. It did very well in Texas but he couldnt expand from there without marketing skills.

That’s were me and these marketing talents came in to help the company explode into 25+ cities!

We did so well that I am now part owner of the company. It’s hibachi at home and called Let’s Hibachi!

PSA: Be on the lookout for this scam hibachi company called RockStar Hibachi!

This post is for people who struggle with credit card debt and saving enough money to never use them again.

I hope you like the guide and hit me up if you have any questions on it!